Frequently Asked Questions

- Go to the South Carolina Judicial Department Public Index website.

- You will get a screen asking to you to accept or decline. Click on the accept button to proceed.

- In the Courts section in the upper left corner are the words Court Agency, click on the drop down arrow and click on Master in Equity. This will show what rosters are available to view.

- Click on what roster you would like to see.

- Click on the Case number and the case will open.

To view a Notice of Sale, you must to come to the Clerk of Court’s office in the Court House.

Because Beaufort County is E-Filing all documents you may be able to see the notice of sale when you click on the case number on the roster, however you will need to repeat the below process more than once:

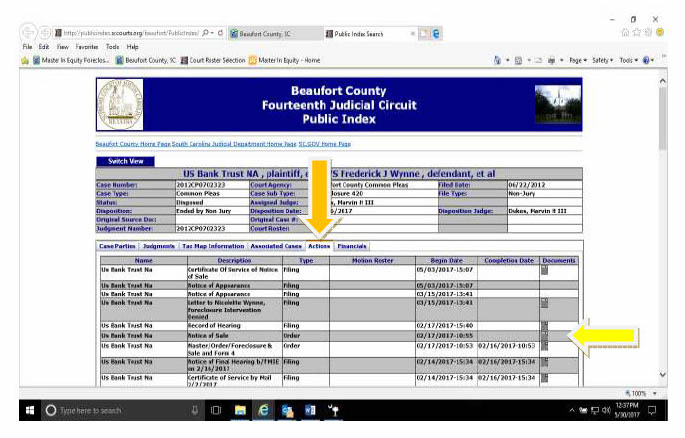

- Click on case number

- Go to tab that says “Associated Cases” click that

- Click on the case number under “case #” (make sure is the same case number you are researching; there may be more than one case listed)

- Go to tab that says “Actions”

- Under “Description” find the document that says “Notice of Sale” and on the far right side corner under “Documents” you should get an icon, click on that and the Notice of Sale will open up. If the Document icon does not appear repeat steps 1-5 again on the next case.

Beaufort County foreclosure sales are usually the result of mortgage foreclosures, in which a lender seeks to have real property sold to attempt to satisfy a delinquent debt. The debt is usually memorialized in a "note", and the right to sell is delineated in the "mortgage" both of which are ordinarily signed at a loan closing. The mortgage memorializes the fact that the real estate has been pledged as collateral for the loan. The term "foreclosure" refers to the Plaintiff's effort to "foreclose" or remove the mortgagor's (borrower's) rights to the property. Other types of foreclosures are timeshare foreclosures, assessment lien foreclosures and mechanic's lien foreclosures.

Sales are held the first Monday of each month at 11:00a.m. in the Beaufort County Court House in one of the Courtrooms (signs are posted indicating the room number). If the first Monday falls on a Holiday the sale will be the next day.

In order to obtain clear title to the property, a Plaintiff must notify all parties who might have an interest in the property. This frequently includes other banks, homeowners' associations, individuals who might hold judgments, and taxing authorities. Usually, a bank names these parties to establish lien priority.

No. The foreclosure sale is open to the public. When a third-party bidder (a bidder other than the Plaintiff) is the successful (highest) bidder, the bidding stops briefly for the Court to obtain the third party bidders information. This includes name, address and driver's license number (or other official photo ID).

The purpose of any civil lawsuit is to attempt to make the Plaintiff "whole", meaning to put the Plaintiff in the same position they would have been in had the Defendant not defaulted.

Most foreclosure cases are "deficiency waived" cases in which the Plaintiff seeks to have the property sold to satisfy the debt. If the property does not bring a sufficient amount to satisfy the debt, the amount unsatisfied, known as the "deficiency", is voluntarily forgiven ("waived") by the Plaintiff.

However, the Plaintiff has the legal right to have the property sold and be awarded a judgment for the difference in the total amount owed and final sales price of the property. This judgment for the difference is called a deficiency judgment. The value of the property combined with the value of the deficiency judgment equals the amount owed to the Plaintiff, theoretically making the Plaintiff "whole". This process is called "demanding a deficiency". A Plaintiff has the right under South Carolina law to demand a deficiency unless it is affirmatively waived.

(Example: Judgment amount = $725,000.00; Property sells for $500,000.00; Deficiency Judgment will be ($725,000.00-$500,000.00)= $225,000.00)

If a Plaintiff demands a deficiency, the law requires that the Plaintiff bid only at the regular sales date, and then the sale remains open until the thirtieth (30) day after such sale exclusive of the day of the sale. A Plaintiff's bid is ordinarily based upon an appraisal or a broker's price opinion, but must be a good faith estimate of value. When the sale is reopened (at a separate auction), final bidding begins at the Plaintiff's bid and continues until the highest bid is accepted. The Plaintiff cannot return and increase its bid at the reopening of the bid. A Plaintiff has the right to waive deficiency right up until the time of the first sale, so bidders interested in a particular parcel of property should be prepared to bid at the first sales opportunity.

Many factors go into a Plaintiff's decision to demand or waive a deficiency including, value of the collateral, collectability of a judgment, and additional costs and time to obtain a deficiency.

The judgment amount is the amount owed to the Plaintiff on the debt being foreclosed (usually) on the date of the judgment. If other total debts are available, it may include those as well. Like all information on the MIE website, judgment debt information is for convenience only and should not be relied on as official or final.

No. Although the title may be clear and marketable, the Master's Office never offers or issues guarantees. Always consult an attorney to determine sufficiency of title.

Not without the express permission of the owner. Entering a property without the permission of the owner can be a criminal act.

No. The successful bidder merely has established their right to complete the bidding procedure and ultimately receive a Master's deed. Until that time, the property is owned by the foreclosure defendant. Entering a property without the permission of the owner can be a criminal act.

Yes, but only subject to applicable procedures and rules and pursuant to the Protecting Tenants at Foreclosure Act.

Approximately 25%-30% of listed properties are "pulled" prior to sale, some at the very last minute. The reasons for a property being pulled vary, but usually it involves a short sale, a forbearance agreement with the Defendant, or a bankruptcy. Pulled properties are sometimes relisted.

The amount of good faith deposit necessary at the time of the sale, is five (5%) percent of the successful bid at the sale, and must be made by 3:00p.m. that same day. This deposit is required to be in certified funds (no cash, no personal checks), and is not refundable. Successful bidders have thirty (30) days to comply with the balance of the bid plus interest with certified funds. It is very important for bidders to have arranged for financing before bidding. Often 30 days is not enough to process loans. Also, without permission of the owner, the property cannot be inspected or entered for appraisal.

Mobile phones and similar devices are prohibited in the Courthouse. Please leave them in your car. If you are the winning bidder, you must have a photo ID and you will be asked to come forward immediately and fill out an information sheet.

If a successful bidder fails to immediately come forward, the bid will be declared void and the property will be resold during the same sale. Fraudulent bidding, or bidding in a false name can result in Contempt of Court sanctions, including fines or imprisonment.

Please note that your bid is a binding contract, breach of which can result in civil damages.

In addition to losing your deposit, you could be responsible for additional damages and banned from future bidding.

After the entire successful bid price has been paid to the Master's office, a Master's deed will be issued to the purchaser (most purchasers have an attorney prepare the deed for them). It is the responsibility of the Purchaser to take the deed to the Beaufort County Register of Deed office for recording. Recording fees are the responsibility of the Purchaser.

No. All properties are sold "as is". Furthermore, the Master in Equity does not guarantee clear title. It is highly recommended that you obtain a lawyer's title report done prior to bidding on or purchasing any property at a sale. It is not unusual to have a property sold subject to prior liens which must be satisfied in order to obtain clear title.

Sales results are often misleading as it appears that properties sold for as little as $2,500.00. Actually, Plaintiffs will often begin the bidding (at a non-deficiency sale) at $2,500.00, but will continue competitive bidding up to a level that protects their interests. Sometimes this level is well below the judgment amount. The reason for these low initial bids relates to an effort to save the costs of commissions and fees which are a multiple of the final bid price. Therefore, if there is no competitive bidding on a property, it will appear as though the Plaintiff bought the property for pennies on the dollar, but in actuality, they have already "spent" the value of the judgment on it.

It is almost always in a Plaintiffs best interest not to be the high bidder at the sale. Plaintiffs would generally prefer to have the sales proceeds rather than the property itself. For this reason, many Plaintiffs attorneys will reveal their bidding instructions prior to sale. Check with Plaintiff's attorneys websites for details.